Understanding ERISA Bond Requirements for Employee Benefit Plans

Plan sponsors and fiduciaries of an employee benefit plan bear great responsibility in providing financial security for assets. An ERISA bond is fundamental to guaranteeing these reserves, but what exactly does it mean? In this blog post, we will explore the importance and necessity of having an ERISA Bond and its requirements when getting one. We’ll also examine how Fiduciary Liability Insurance provides additional protection for those with such plans to meet their obligations better and confidently. By understanding both forms of coverage, plan sponsors and financial advisors are given insight into best practices on safeguarding benefit plans through bonds or purchasing fiduciary liability insurance through policies, all necessary steps towards successful implementation!

Short Summary

- ERISA Bond is an insurance designed to protect participants in employee benefit plans from any fraudulent or dishonest actions taken by plan fiduciaries.

- Plan sponsors must regularly review and update their bond coverage to ensure adequate protection for employee benefit plans and compliance with ERISA regulations.

- Fiduciary liability insurance provides extra security, offering protection from potential losses due to unintentional errors in plan management.

ERISA Bond Explained

Employee benefit plans are safeguarded by an ERISA bond, also known as a fidelity bond. It is required for those that manage funds or other assets of the plan to obtain such coverage under ERISA regulations with at least 10% equal in terms of its protection value related to the plan’s assets. The purpose here is to secure participants’ interests against fraudulent or dishonest activities conducted by fiduciaries running them. These fidelity bonds serve as safety nets due to their ability to combat losses from malpractice and employee dishonesty insurance, ensuring these schemes continue functioning well without incident. They differ from fiduciary liability insurance though each offers protection for employee benefits. They Operate differently, tackling different risks associated with it, respectively speaking.

Importance of an ERISA Bond

ERISA and fidelity bonds are essential for ensuring the soundness of employee benefit plans. They ensure plan fiduciaries comply with applicable laws and fulfill their obligations to participants while protecting against any losses from dishonesty or fraud. Thus, they offer a safeguard for individuals in these plans by offering fidelity bond coverage that guarantees protected assets. Plan sponsors can guarantee financial security through adequate bonding, giving peace of mind to plan members and trust in the plan itself.

ERISA Bond vs. Fiduciary Liability Insurance

ERISA bonds and fiduciary liability insurance are necessary for plan sponsors and financial advisors to protect employee benefit plans from various potential risks. ERISA is a state of emergency. Bonds provide coverage against losses caused by theft or dishonesty, whereas Fiduciary Liability Insurance offers protection when unintentional mistakes in administering the benefits occur. This insurance policy also covers legal defense costs and any settlements resulting from such issues. All-in-all, having an ERISA bond and fiduciary liability insurance is essential to ensure complete security for managing employee benefit plans.

ERISA Bond Requirements

According to the Department of Labor, all ERISA bonds must have a coverage amount of at least 10% of the total plan’s assets of assets. This will guarantee that in case the fiduciaries commit wrongdoings, sufficient protection is provided against losses from them. The actual value may differ depending on plan asset totals and relevant state laws and regulations. For sponsors to stay compliant with DOL demands, they should keep their bonds current by regularly updating their values related to changed/fluctuating asset amounts or any other factor mentioned above.

To satisfy regulatory requirements thoroughly, it’s essential for them continually monitor these parameters associated with their particular bond policy, which affords added financial security.

Determining Bond Value

Plan sponsors must remain compliant with ERISA regulations and protect employee benefit plans by regularly updating the minimum and maximum bond value used for coverage according to the plan asset value. The minimum of 10% for a bond value is essential, and the maximum is $500,000 or $1 million in employer securities cases. Monitoring how these figures fluctuate enables employers to guarantee adequate asset protection.

Bond values are also proportional: when total plan assets increase, the Bond Value Coverage must ensure that appropriate safeguarding remains at the maximum and minimum bond value at all times.

Compliance with Department of Labor Regulations

To comply with Department of Labor (DOL) regulations and avoid penalties, any individual working with the funds or other assets in an employee benefit plan must be adequately bonded out for a minimum amount equal to 10% up to a maximum bond of \$500,000. Some exemptions may exist. Plan sponsors and fiduciaries must review their coverage regularly to stay compliant, as assets can change over time. Failing to abide by DOL rules could incur civil and criminal consequences, including disqualification from managing these plans altogether.

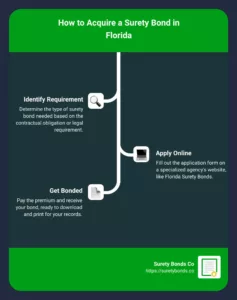

Purchasing an ERISA Bond

Securing an ERISA bond is a straightforward process that can be completed online. Begin by choosing a trustworthy provider approved by the Treasury Department to ensure appropriate standards and suitable protection are met. After selecting your chosen provider, complete their online application form for a free quote on the minimum bond amount required. Certain states – such as Georgia, Louisiana, South Carolina, or Tennessee – offer state-specific options for employee benefit plans in those areas with coverage tailored to their unique requirements.

Georgia Erisa Bond

Plan sponsors in Georgia can protect their employee benefit plans by getting a bond as required under ERISA regulations. This Georgia ERISA is for Georgia. Bonds must be for an amount ranging from $1,000 to $500,000—the maximum being 10% of the funds entrusted into care. The purpose is to safeguard against potential financial losses due to fraud or mismanagement by the plan sponsor or officials managing said plans.

Louisiana ERISA Bond

It protects against any losses due to fraudulent or dishonest acts by fiduciaries and those handling funds of an employee benefit plan located within this state. The bonding company used for this purpose must have been approved by the Louisiana Department of Insurance using their specific form so that coverage can meet all requirements found in such plans. This requirement also applies to protecting other property in these retirement income security act plans.

South Carolina Erisa Bond

The Department of Labor requires ERISA bonds to be worth a minimum value of $1,000 and a maximum amount of up to $500,000. This should account for 10% or more of the employee benefit plan’s total assets to protect them from dishonest acts or mismanagement. Similarly, this applies to any employee benefit plans operating within South Carolina, ensuring proper security measures through bond protection have been taken.

Tennessee Erisa Bond

Plan sponsors need to obtain a Tennessee ERISA fidelity Bond for their employee benefit plans to abide by federal and state regulations. This fidelity bond protects acts or mismanagement, with the value of this required bond ranging from $1,000 – $500,000, totaling at leatotalingan assets. By procuring such a bond through the Department of Labor, they can ensure that all requirements are met within compliance standards.

Choosing a Reputable Provider

When selecting a respected ERISA Bond provider, reviewing those accepted by the Treasury Department and with experience in providing such bonds is essential. Ensure that the bond is equivalent to any non-qualifying assets and needs auditing each year by a certified public accountant. A dependable service partner like Suretybonds.co will guarantee compliance and adequate protection for your employee benefit plan through their highly reliable coverage given via ERISA Bonds. Doing ample research before finalizing your selection can give you greater peace of mind in trusting this provider for quality services.

Online Application and Retroactive Coverage

ERISA. Bonds have become easier to acquire for plan sponsors and fiduciaries due to the convenience of online application processes. With our easy-to-use online application form, you can quickly fill out and receive an instant quote to obtain the bond required by ERISA regulations. For employers starting who require protection for their employee benefit plans, retroactive coverage options make it much more straightforward, allowing them to purchase a Bond even after establishing the plan itself; contact us for more details.

Reporting and Maintaining ERISA Bond Coverage

Plan sponsors and fiduciaries must secure a fidelity bond, with an amount that is at least 10% of the funds handled by the official concerned and no less than $1000 per plan. This bond protects from fraud or dishonesty committed by anyone responsible for handling money related to employee benefit plans.

Regularly reviewing this coverage should be done so any adjustments made regarding assets are implemented correctly. Failure of unlawful acts may lead to non-adherence to Department of Labor regulations, resulting in fines. By actively monitoring their ERISA Bond policy, it guarantees continued security for everyone’s investment within these benefits schemes.

Monitoring Plan Assets

Regular monitoring of plan assets is paramount for protecting the fiduciary duties of trustees, adhering to ERISA regulations, and avoiding any penalties from the Department of Labor. To ensure suitable supervision, it’s essential to scrutinize investment performance and fees, conduct periodic appraisals regarding allocated investments, and review all pension plans and assets documents.

For successful plan asset management, thorough evaluations must be conducted regularly about the services offered so that costs remain reasonable while achieving better investment returns. Plan sponsors need assurance they are following best practices by taking necessary steps toward proper review to maintain a sound system.

Penalties for Inadequate Coverage

Plan sponsors and fiduciaries must ensure that their bond coverage accurately reflects the plan’s assets and assets to avoid possible penalties, investigations by the Department of Labor (DOL), or other liability exposure. Not ensuring a sufficient amount of fidelity bond coverage equal part of this protection on Form 5500 can lead to an audit and potential sanctions, so they must keep updated records regarding their respective bonds.

Additional Protection: Fiduciary Liability Insurance

Fiduciary liability insurance is essential for plan sponsors, financial advisors, and institutions to protect against personal liability for any unintentional mistakes when managing employee benefit plans. This particular type of coverage should be purchased separately from an ERISA Bond as it offers a different kind of security that can help shield the employer from protecting those involved in the administration process from personal liabilities due to errors or omissions.

This additional layer of safety gives peace of mind. It guarantees the success and stability of financial institutions associated with these benefits plans, helping ensure ongoing assurance regarding their sound management practices.

Coverage Scope

Fiduciary liability insurance is an additional protection for plan sponsors and financial advisors that extends beyond the coverage offered by ERISA bonds. It covers legal defense costs, settlements, court-awarded damages, and expenses associated with investigating potential breaches in managing employee benefit plans from unintentional mistakes or omissions. It also safeguards those involved against dishonest acts not included in a regular bond’s protection. It reduces their exposure to possible liabilities while safeguarding their employee benefit plans.

Importance for Plan Sponsors and Financial Advisors

Fiduciary liability insurance can protect plan sponsors and financial advisors from any personal liability for losses stemming from unintentional errors in employee benefit plan management. It is a valuable security measure to guard against any dishonest acts of employees that may lead to financial loss, thus safeguarding the effectiveness of plans in the future. Through this form of purchase fiduciary liability insurance coverage, these individuals are covered for their liabilities if mistakes were made while managing an employee benefit plan without intent or negligence. This additional layer of protection gives them peace of mind as they confidently handle these complex systems. It serves as assurance should unjustified claims be filed against them due to potential misdeeds by employees under supervision who have access to funds within the benefits program budgeted outlay area.

Summary

As a plan sponsor or financial advisor, it is imperative to understand the significance of ERISA bonds and fiduciary liability insurance when managing employee benefit plans. These two forms of protection guard these plans against losses due to fraudulent behavior by individuals in charge and prevent any unintentional errors made during administrative processes. Acquiring an understanding of how each works and meeting requirements for such coverage will assure employees that their benefits are safeguarded securely.

ERISA Bonds safeguard a benefits plan’s assets against any dishonest acts committed by those handling them. At the same time, Fiduciary Liability Insurance covers mistakes arising out of mismanagement unintentionally caused when administering said programs. Having complete knowledge about both types of insurance coverage is essential for all involved parties to ensure that no risks affect the safety of employee assets held within given savings schemes – thus fulfilling expectations placed upon employers/advisors through the realization of fiduciary responsibility demands assigned with this particular matter.

Securing bond premiums quickly allows stakeholders the necessary resources to protect requested interests and other property, like improved short-term solvency. Thereby allowing participants confidence knowing they have access to funds set aside should some unexpected event occur along one’s retirement journey paths going forward into future days.

Frequently Asked Questions

What is an ERISA bond?

An ERISA bond is a type of surety bond required by the Employee Retirement Income Security Act (ERISA) for fiduciaries of retirement plans. The bond guarantees that the fiduciary will administer the plan by ERISA and will protect the plan’s assets from loss due to fraud or dishonesty.

Why are ERISA bonds required?

ERISA surety bonds are required to protect the participants in retirement plans from losses that may occur due to the actions of dishonest or fraudulent fiduciaries. The bond also helps to ensure that fiduciaries are acting in the best interests of the plan’s participants.

How much does an ERISA bond cost?

The cost of an ERISA surety bond varies depending on the amount of the bond and the surety company. The bond amount is typically based on the size of the plan’s assets.

How do I get an ERISA bond?

You can get an ERISA surety bond from a surety company. To get a bond, you must provide the surety company with information about the plan, including the plan’s assets and fiduciaries.

What are the benefits of getting an ERISA surety bond?

There are several benefits to getting an ERISA surety bond. These include:

- Protecting the plan’s participants from losses due to fraud or dishonesty.

- Helping to ensure that ERISA is administering the plan.

- Making it easier to obtain a plan sponsor bond.

What are the requirements for an ERISA bond?

The requirements for an ERISA bond vary depending on the surety company. However, some standard requirements include:

- The bond must be in writing and signed by the principal and surety.

- The bond must be for a specific amount.

- The bond must be issued by a surety company licensed to do business in the state where the plan is located.

What happens if I don’t get an ERISA bond?

If you do not get an ERISA bond, you may not be able to obtain a plan sponsor bond. In addition, if a fiduciary commits fraud or dishonesty, the plan’s participants may be able to sue the fiduciary personally for losses.

What happens if I file a claim on my ERISA bond?

If you file a claim on your ERISA bond, the surety company will investigate the claim. If the claim is valid, the surety company will pay the claim up to the bond amount.

How do I renew my ERISA bond?

Your ERISA surety bond will need to be renewed regularly. The renewal process varies depending on the surety company. However, you will typically need to provide the surety company with updated information about the plan, including the plan’s assets and the plan’s fiduciaries.

What are the different types of ERISA bonds?

There are two main types of ERISA surety bonds:

- Fiduciary bonds: These are required for individuals administering a retirement plan.

- Plan sponsor bonds: These are required for organizations that sponsor a retirement plan.

Is an ERISA bond the same as a 401k bond?

A 401k bond is not the same as an ERISA fidelity bond. The latter is insurance that covers fraud or dishonesty among “plan officials” concerning 401(k) plans. On the other hand, a 401k plan entails employers matching employee contributions into retirement funds without involving ERISA fidelity bonds.

What is the difference between an ERISA bond and a fiduciary bond?

The two types of bonds, ERISA fidelity bond, and fiduciary liability insurance, guarantee the protection of assets in such a plan. The former guards the participants while the latter shields and handles funds and those who manage it or own it as an entity. In essence, both these bonds ensure that everything related to that particular financial arrangement is always kept secure.

Do you need an ERISA bond for 401k?

ERISA regulations require a bond for all 401(k) plan money handlers to protect the funds from potential fraudulent activities or employee dishonesty. This bonded protection helps safeguard against losses due to illegal behavior.

What is the difference between ERISA coverage and ERISA bond?

ERISA coverage is an important safeguard against breaches of fiduciary duty, or employee theft, while the ERISA bond serves as a way to protect employee benefits plans from potential fraud or dishonesty by plan administrators. This makes it crucial for organizations to acquire this type of bond in order to secure their employees’ benefit programs.

What is the primary purpose of an ERISA bond?

ERISA bonds are a crucial part o the legal framework. At the same time, it safeguards employee benefit plans and their beneficiaries. These surety-issued bonds protect plan assets from fraudulent activities or misuse of plan funds by those in control of plan funds, as mandated by Employee Retirement Income Security Act (ERISA). They provide financial assurance to participants who can rely on these guarantees for security regarding their retirement incomes.